An intuitive Cloud ERP system to power your whole business

Get the business management system with the highest customer satisfaction rating in the industry.

▶️ Watch overview videoSchedule a demo

Building the future of business, together.

Community is our foundation. It drives innovation, empowers individuals, and enables growth. Our customers, our partners, our people – it takes all of us.

"Acumatica helps customers win at business, and they're passionate about making the world a better, more inclusive place. Can't wait to represent them out on the course!"

Enjoy the Summit 2024 experience from your home or office. Watch the on-demand Keynote Presentations live from Las Vegas!

“Acumatica’s cutting-edge technology and forward-thinking approach perfectly align with the fast-paced worlds of IMSA and INDYCAR racing.”

Why Acumatica Cloud

Enterprise Resource Planning (ERP)?

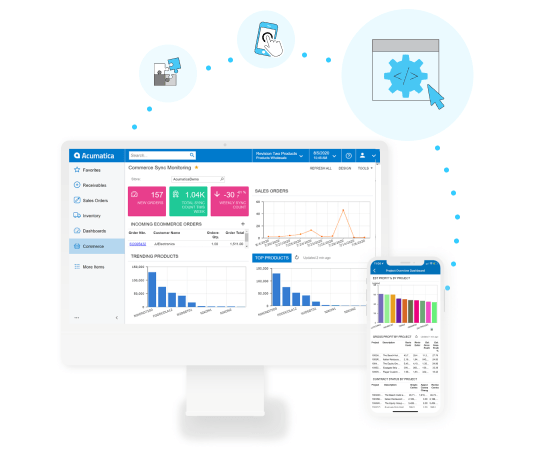

Exceptional usability

A true Cloud ERP solution

An award-winning platform

Exceptional usability

Acumatica was born in the cloud, built to meet the ever-evolving needs of midmarket companies and their customers.

- Easily integrate the tools and systems you already use

- Improve efficiency with our intuitive, award-winning UI

- Empower collaboration with modern, cross-module workflows

- Access your data from any device

- Personalize your instance in a low-code / no-code environment

- Scale users and resources up or down as needed

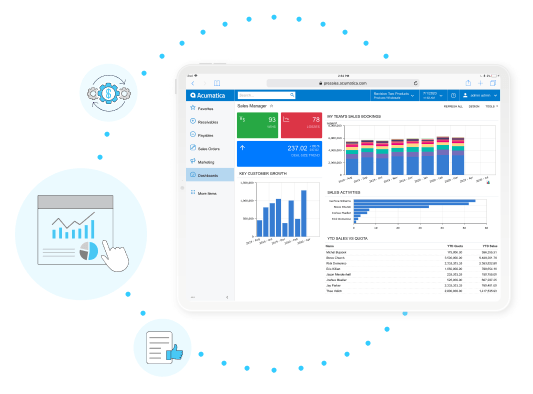

A true Cloud ERP solution

Intelligent, industry-focused business functionality that helps growing companies see and connect every facet of their business in the cloud.

- Gain real-time business insights from a single source of truth

- Simplify and synchronize automation across multiple workflows

- Get consistent, coordinated views of current accounts

- Enjoy flexible licensing that ensures you’re never punished for growing

- Maintain compliance while reducing overhead (GDPR, SOC Type 1 & 2, PCI DSS, and more)

An award-winning platform

Acumatica was built around customer—not shareholder— requirements.

- The industry’s highest customer satisfaction ratings

- Flexible deployment options: public or private cloud

- Modern pay-as-you-go, consumption-based licensing that can grow/shrink with your needs

- ERP implementations without hidden fees

- Dual layers of support

We put our customers first

The reason Acumatica has been the world's fastest-growing Cloud ERP company for 8 years and counting.

View customer success storiesAll-in-one Cloud ERP software

Best-in-class business and industry-specific solutions that can be easily tailored to meet the needs of your growing company

Financial Management

Financial Management

A full suite of accounting functions and reporting tools, to meet the needs of growing companies

Commerce Connectors

Commerce Connectors

Acumatica’s native integrations with Amazon, BigCommerce, and Shopify enable you to connect your eCommerce storefront with Acumatica’s financials, inventory, product…

Construction Management

Construction Management

Acumatica’s Cloud ERP Construction Management software is built to equip construction firms with powerful business intelligence—because visibility drives success.

Manufacturing Management

Manufacturing Management

Get real-time insights and end-to-end control of your production and your financials, so you can drive efficiency and grow your…

Inventory Management

Inventory Management

Simplify your inventory processes with flexible item management, quality traceability, and robust replenishment to balance supply and demand. Optimize stocking…

Warehouse Management System

Warehouse Management System

Streamline warehouse operations and transactions to reduce errors, automate processes, and increase productivity

Integrate the tools

you already use

We play nicely with others. See how Acumatica integrates seamlessly with your existing tech stack.

Visit the Acumatica MarketplaceMost Popular Resources

Analyst Reports

Product Materials

Analyst Reports

Product Materials