Introduction to Job Cost Accounting in Construction

In general financial accounting, business-wide costs and revenues are tracked, ensuring tax compliance and informing investors, creditors, and management about a business’s overall financial performance.

Job cost accounting is a method of tracking costs and revenue for individual projects within a business.

This detailed approach helps contractors understand the profitability of each project, identify areas for cost savings, and make informed decisions about future bids.

For construction professionals, accountants, and project managers, job cost accounting is a critical component of project success. So, today, we’ll cover the principles of job cost accounting, explore its importance in construction, and highlight best practices for effective job cost software implementation.

What is Job Cost Accounting in Construction?

Construction projects are multi-layered and complex. They must meet each customer’s specific location, resource, and labor needs—factors which also determine each project’s budget.

With job cost accounting, which is equivalent to project accounting in other industries, business leaders have a complete view of construction project-related costs. These costs are used to build a concise project budget and identify inefficiencies and excess costs.

Key Components of Job Cost Accounting

Understanding the key components of job cost accounting begins with understanding how construction projects evolve.

Capture job costs by project and view labor, time, and material cost changes in real-time. Automate change order processes to control job cost overruns.

New construction projects begin with gathering potential customers’ project information. Based on their requests, the construction firm creates a cost estimate and prepares a complete bid package. This package highlights the total cost to complete, contracts, budgets, sub-jobs, and the schedule of values.

Here’s a look at what’s included in the total cost to complete:

- Direct expenses (e.g., equipment rentals, utilities, temporary office structures, and project-related salaries)

- Indirect expenses/overhead costs (e.g., insurance, office/rent, marketing, and employee expenses for all projects within the firm)

- Labor (e.g., employee and subcontractor wages along with administrative expenses)

- Materials (e.g., lumber, steel, concrete, plumbing fixtures)

- Equipment (e.g., excavators, cranes, bulldozers)

These total cost to complete expenses are also the key components of job cost accounting.

Purpose of Job Cost Accounting in Construction

Budgeting and Cost Control

A construction project’s budget is the project manager’s one-stop guide to financial, client relationship, and decision-making success. It determines how much should be spent on project resources, how those resources should be allocated, and how the actual costs compare to the approved budget.

If the project’s bid package is accurate and the project manager adheres to the budget, the project is profitable, boosts the construction company’s reputation, and strengthens current and future client relationships.

Profitability Analysis

In addition to establishing a favorable reputation and securing customer loyalty, job cost accounting aids construction businesses in assessing costs and revenue on a per-project basis. Making a profit—the revenue that goes into a company’s bank account after business expenses are paid—is only possible when a business, using historical data from other, similar projects, accurately estimates its project costs.

These estimated costs are then used to analyze a project’s profitability (or lack thereof) and to help the business determine if the project should or should not move forward.

Types of Accounting Used in Construction

Both general financial accounting and job cost accounting are used in the construction industry.

As we discussed, general financial accounting in construction involves managing (e.g., identifying, monitoring, analyzing, and disbursing) current business-wide financial information. This information is used to make strategic daily business decisions.

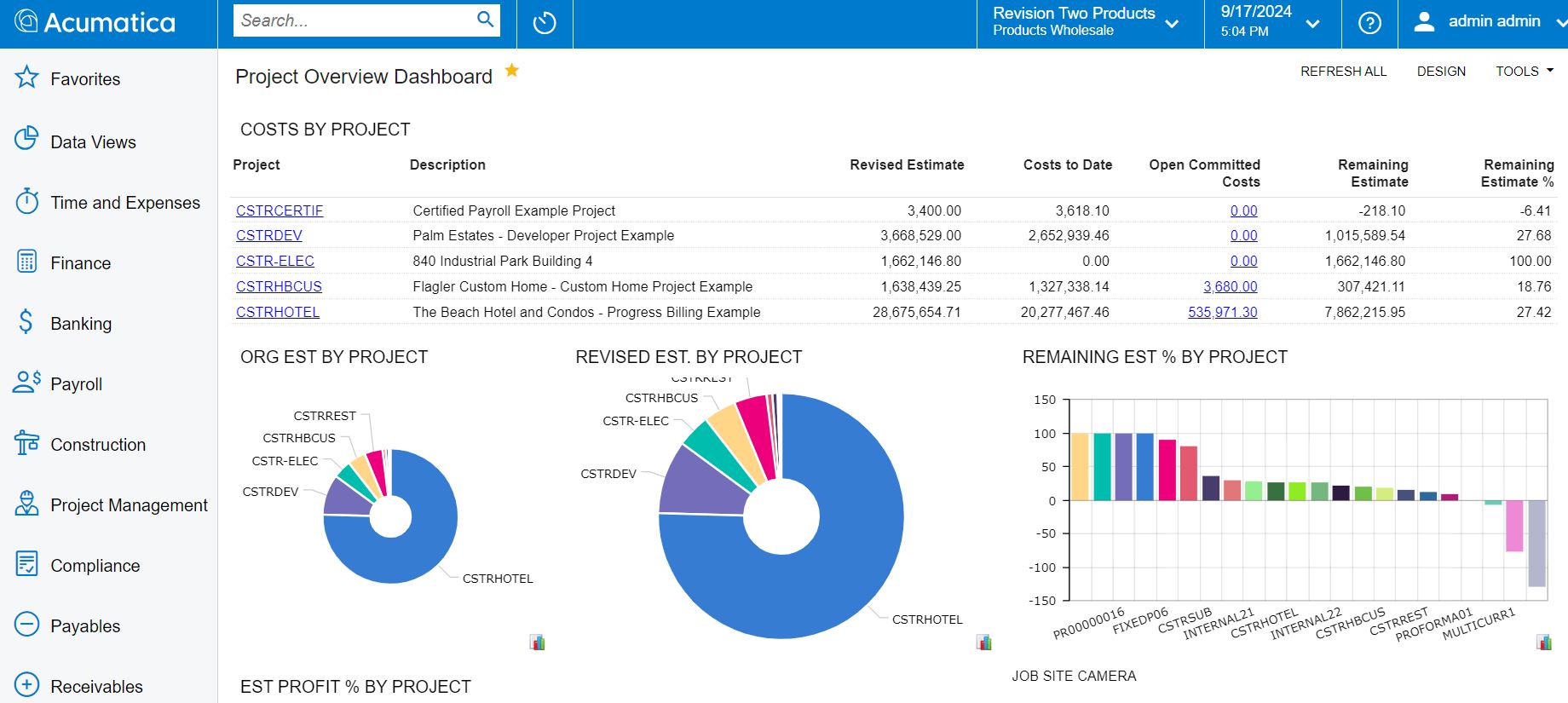

Job cost accounting helps project managers oversee particular projects, delivering insights into per-job costs, including cost to complete, cost at completion, and percentage of completion. Project managers have visibility across project, finance, customer account, and inventory information and related business processes.

Together, general and job cost accounting let business leaders and project managers know how well their company is performing and provide the information they need to become—and remain—profitable. But to reap these impressive and vital accounting benefits, businesses must implement the right job costing software.

Best Practices for Implementing Job Cost Accounting

Choosing the Right Accounting Software for Job Cost

In today’s digital economy, there are many job costing software options, but most are standalone solutions that provide only basic accounting functionality. For small businesses just getting started, a simple job costing solution may suffice. Unfortunately, as small businesses evolve and their accounting needs become more complex, entry-level accounting solutions can’t keep up.

That’s where enterprise resource planning (ERP) solutions, like Acumatica, can help.

Acumatica’s Construction Management Software provides real-time insights that enable project managers to stay on top of every project and budget. As a single source of truth, Acumatica empowers users to manage customer relationships, project operations, change orders, financials, and project accounting needs from one place—anywhere, at any time, from any device. And employees in the office and in the field enjoy an accurate, up-to-date snapshot of every project.

“With Acumatica Construction, we have access to current data that helps us understand where our business is coming from, how profitable it is, and just where it stands at any point in time,” says Acumatica customer Eric Hugunin, COO, Phoenix Renovation and Restoration. “It’s not a coincidence that, since going live on Acumatica, we haven’t needed to tap into our line of credit in 14 months, and we are operating cash flow positive for the longest period in 22 years.”

Training and Process Integration

When construction businesses decide to implement Acumatica, expert business partners will walk them through every step of the integration process. They’ll also have access to Acumatica’s complimentary Acumatica Open University, which offers self-study materials and courses, and to the self-service Acumatica Customer Portal, which instantly connects customers to the latest support and educational content.

Having training and support services at their fingertips means construction businesses can train their teams quickly and easily on how to harness job cost accounting principles and integrate them with their existing processes.

Conclusion

Acumatica’s cloud-based ERP solution and native job costing software enable construction professionals to automatically capture labor, material, and equipment costs and report on them in one, comprehensive solution. Staying on budget, creating accurate and timely bid packages for prospective projects, and solidifying customer relationships have never been easier or more enjoyable.

Says Elizabeth Barratt, Manager of Project Excellence at Ask Afrika, “Acumatica works perfectly. It handles project accounting, cash flow, and project monitoring, but Acumatica is not confined to project-based operations. Other departments like sales and marketing love it as well.”

Canada (English)

Canada (English)

Colombia

Colombia

Caribbean and Puerto Rico

Caribbean and Puerto Rico

Ecuador

Ecuador

India

India

Indonesia

Indonesia

Ireland

Ireland

Malaysia

Malaysia

Mexico

Mexico

Panama

Panama

Peru

Peru

Philippines

Philippines

Singapore

Singapore

South Africa

South Africa

Sri Lanka

Sri Lanka

Thailand

Thailand

United Kingdom

United Kingdom

United States

United States