Intro

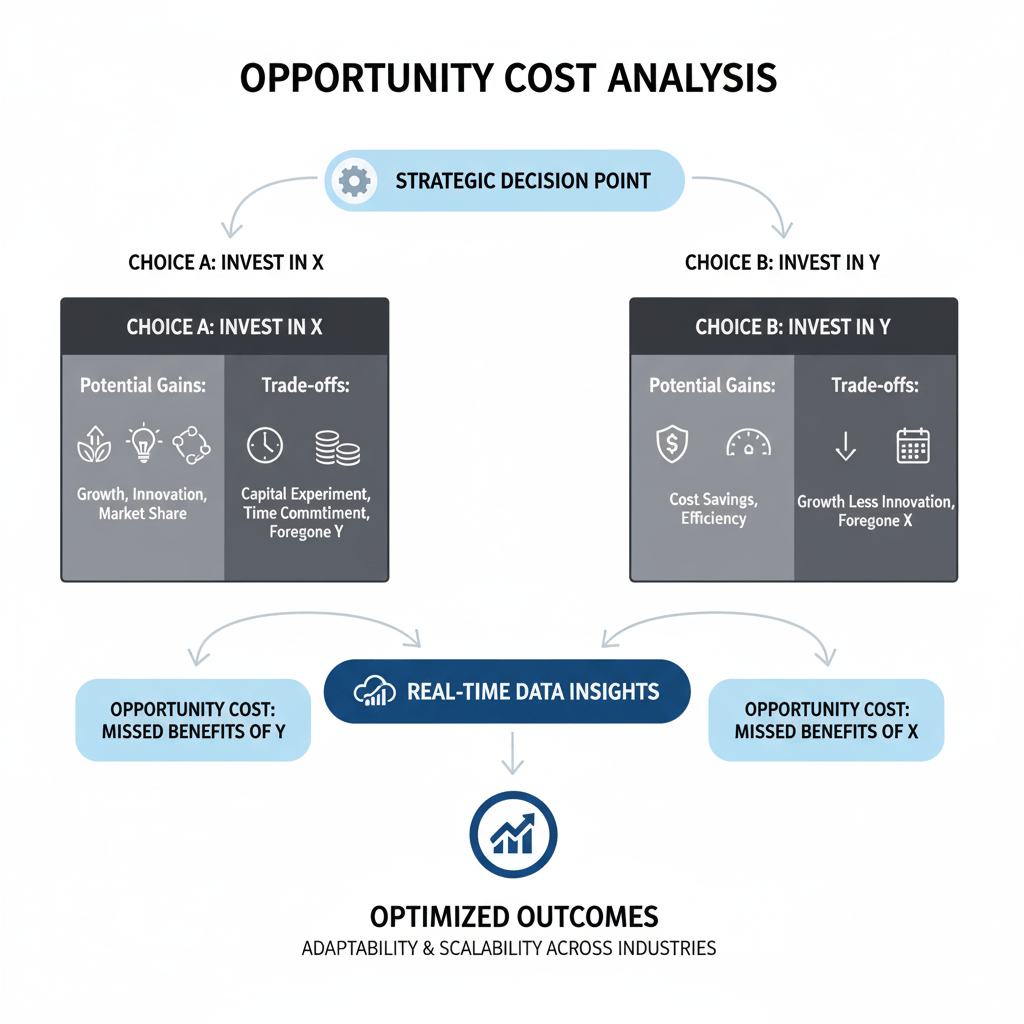

Understanding opportunity cost is essential for making informed, strategic decisions that drive real business growth.

This article breaks down the definition and formula of opportunity cost, illustrates how it influences everything from daily choices to long-term investments, and provides actionable steps to identify and measure both implicit and explicit costs.

By connecting real-world examples and highlighting tools that simplify complex calculations, you will discover how opportunity cost empowers your organization to minimize risk, boost efficiency, and confidently pursue the options that deliver the greatest value.

What is Opportunity Cost?

Opportunity cost is the value of the next best alternative that is forgone when a decision is made. In business terms, it represents the revenue or growth you didn’t achieve because you invested your time, money, or resources elsewhere.

For example, if a manufacturer uses its factory to produce Chair A instead of Chair B, the opportunity cost is the profit they would have made from selling Chair B.

Opportunity cost is the potential benefits and profits the forgone options would have provided. It’s what choosing one opportunity costs you.

Every day, business leaders face difficult choices. Whether deciding to launch a new product, invest in new technology, or hire more staff, saying “yes” to one option often means saying “no” to another. Understanding the true cost of those trade-offs is the key to:

- Optimizing Resources: Ensure capital and labor are used where they generate the highest ROI.

- Minimizing Risk: Evaluate the potential downsides of ignoring specific market opportunities.

- Driving Growth: Make informed decisions that align with long-term strategic goals rather than short-term gains.

What Is a Business Opportunity?

A business opportunity is any use of limited resources that competes with other priorities, such as:

- A new product line, market expansion, or pricing change

- Hiring, training, or outsourcing

- A technology investment (ERP, WMS, ecommerce, automation)

- Inventory strategy (stock more, stock less, change suppliers)

- A financing choice (pay down debt, raise capital, reinvest cash)

However, not every opportunity is worth pursuing. A strategic risk analysis is necessary to vet opportunities against your current production capabilities, financial health, and long-term vision.

How to Calculate Opportunity Cost

Now, let’s look at an example of opportunity cost (or cost per opportunity). Assume you have two prime business opportunities that pass the production, financial, and risk smell tests. Even though both look good on paper, you can only choose one. How do you calculate the opportunity cost of choosing one over the other?

Here’s the Opportunity Cost Formula:

(Return of Alternative Option) – (Return of Chosen Option) = Opportunity Cost

Opportunity Cost Example

Imagine your company has limited capital and must choose between two mutually exclusive projects:

- Option A: Investing in a new marketing campaign expected to generate $100,000 in additional revenue.

- Option B: Upgrading equipment expected to generate $75,000 in additional revenue.

If you choose Option B, the calculation would look like this:

($100,000 from Option A) – ($75,000 from Option B) = $25,000

In this scenario, the opportunity cost of choosing Option B is $25,000. This means the business effectively lost $25,000 in potential revenue by making the less profitable choice.

Implicit vs. Explicit Costs in Business

To accurately calculate ROI, you must understand the two types of costs involved in any business decision: explicit and implicit costs.

- Explicit Costs: These are tangible, out-of-pocket expenses that are recorded in your accounting books. They involve a direct exchange of money. Examples: Rent, utilities, employee salaries, raw materials, and equipment purchases.

- Implicit Costs: These are intangible costs that do not involve a direct cash outflow and are not typically recorded on financial statements. They represent the value of resources already owned by the firm that could have been used differently. Examples: The time a founder spends training employees instead of generating sales, or using a building you own for operations instead of renting it out for income.

How Opportunity Cost Drives Strategic Business Decisions and Growth

The goal of every business is to grow. Growth can be organic (e.g., designing/selling new products, increasing efficiency, investing in new technologies), inorganic (e.g., via corporate mergers, acquisitions, and takeovers), or a combination of both.

To ensure that you’re making strategic business decisions that will encourage growth, you’ll need to compare the short-term and long-term consequences of your options.

Opportunity cost acts as a reality check. It forces leaders to look beyond the immediate benefits of a decision and consider the “unseen” potential of the paths not taken. By consistently choosing the options with the lowest opportunity cost (and therefore the highest relative gain), companies can sustain growth and stay competitive.

The Role of ERP Systems in Opportunity Cost

While opportunity cost is not a line item on a balance sheet, modern technology makes it easier to visualize and calculate. Cloud ERP SOLUTION (Enterprise Resource Planning) systems provide the unified data access needed to evaluate these trade-offs accurately.

Without a centralized system, data remains siloed, making it difficult to see the full picture of your financial and operational health. An ERP SOLUTION integrates finance, operations, and sales data, allowing you to model different scenarios and predict outcomes with greater precision.

Real-World Success: Saddleback Leather

Sometimes, the opportunity cost isn’t about a product, but about the technology you run your business on.

Saddleback Leather, a maker of high-quality leather goods, initially used Oracle NetSuite. However, the system struggled to meet their needs. Founder and CEO Dave Munson noted, “Nothing worked fresh out of the box… It was always a downgrade with NetSuite.”

The costs of staying with the legacy system were high:

- Explicit Costs: $230,000 annually in fees plus millions for a 14-person development team.

- Implicit Costs: Lost sleep, low morale, and the inability to execute new ideas.

The Switch to Acumatica

By switching to Acumatica, Saddleback realized massive gains that highlighted the opportunity cost of their previous situation:

- Saved $750,000 per year in IT and operational costs.

- Reduced IT staff from 14 developers to just 2.

- Increased organic traffic by 45%.

- Boosted system functionality by 10x.

The opportunity cost of staying with NetSuite would have been millions of dollars and stalled growth. By moving to a flexible, cloud-native ERP solutionN, Saddleback empowered its team to innovate and grow.

FAQs

Q: What is the difference between sunk cost and opportunity cost?

A: A sunk cost is money that has already been spent and cannot be recovered, whereas opportunity cost refers to potential future returns from an alternative choice. Sunk costs should not influence future business decisions, while opportunity cost should be a primary factor.

Q: Can opportunity cost be negative?

A: No, opportunity cost is typically expressed as a positive number representing the value of the forgone alternative. If the chosen option yields a higher return than the alternative, the “loss” relative to the alternative is zero, but the concept is used to ensure the most profitable option is always selected.

Q: Why is opportunity cost considered a subjective measure?

A: While explicit costs are factual and recorded, implicit costs (like the value of time or effort) often require estimation. Different managers may value the potential ROI of a forgone opportunity differently based on their risk tolerance and strategic outlook.

Canada (English)

Canada (English)

Colombia

Colombia

Caribbean and Puerto Rico

Caribbean and Puerto Rico

Ecuador

Ecuador

India

India

Indonesia

Indonesia

Ireland

Ireland

Malaysia

Malaysia

Mexico

Mexico

Panama

Panama

Peru

Peru

Philippines

Philippines

Singapore

Singapore

South Africa

South Africa

Sri Lanka

Sri Lanka

Thailand

Thailand

United Kingdom

United Kingdom

United States

United States