Retained Earnings

Retained earnings are a powerful financial metric, helping to fuel reinvestment, drive growth, and shape a company’s financial health.

Understanding the Essentials

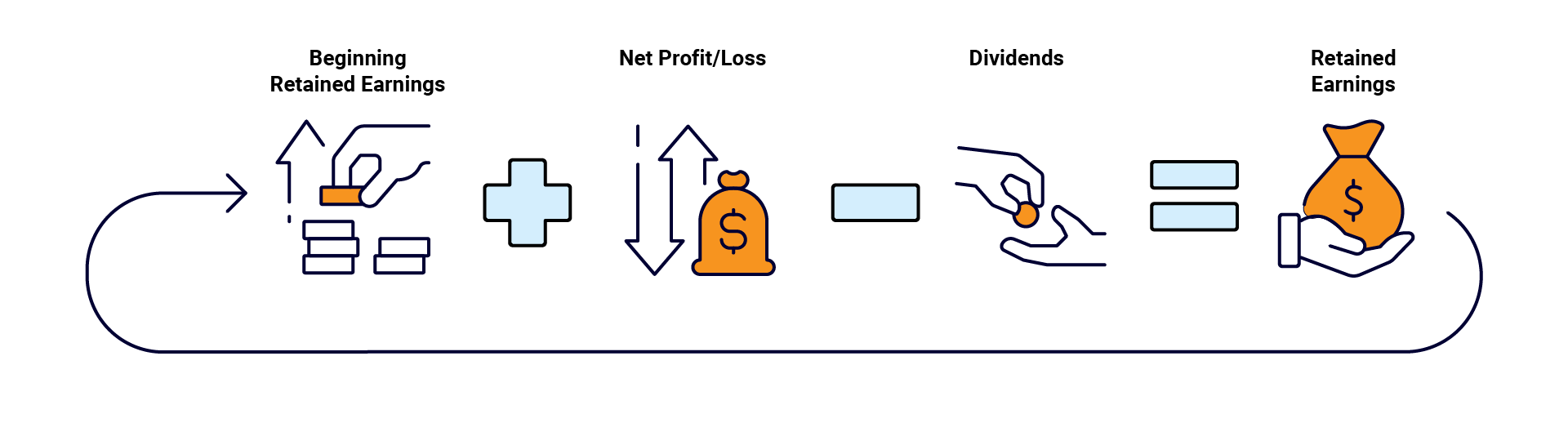

Simply put, retained earnings (RE) reflect a company’s accumulated profits after accounting for dividends paid to shareholders. They help reveal a company’s financial health and are watched closely by shareholders who want to make sure their investments are producing growth and delivering long-term success.

How retained earnings are used is often decided by company management, but shareholders can affect the decision through a majority vote. Still, most management teams and shareholders agree that RE should be reinvested into the business.

Examples of reinvestments include launching new products, buying additional equipment, acquiring new partnerships, advancing research and development, or paying off debt. Some companies also choose to reward their shareholders with additional dividends or offer share buybacks, while others let the RE accumulate, contributing to their overall equity.

If done well, these investments result in a positive retained earnings balance, which typically equates to profitability. If not done well, a negative retained earnings balance results, pointing to potential financial distress. For investors, lenders, and shareholders, knowing that a company can pay for capital expenditures, research and development, debt, and more inspires confidence in the company and assures them that their investments are being managed wisely.

Canada (English)

Canada (English)

Colombia

Colombia

Caribbean and Puerto Rico

Caribbean and Puerto Rico

Ecuador

Ecuador

India

India

Indonesia

Indonesia

Ireland

Ireland

Malaysia

Malaysia

Mexico

Mexico

Panama

Panama

Peru

Peru

Philippines

Philippines

Singapore

Singapore

South Africa

South Africa

Sri Lanka

Sri Lanka

Thailand

Thailand

United Kingdom

United Kingdom

United States

United States