Corporate Banking Operations Platform

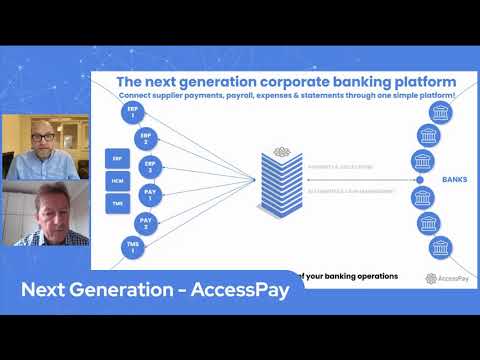

The AccessPay Platform connects corporates to banks and banks to corporates. Through an integrated connectivity layer, we enable organisations to access financial services from banks, third-party service providers and fintech companies in Acumatica, or any other back-office system of choice.

Moving transaction data between multiple banking portals and back-office systems isn’t always a straightforward process, especially if you’re dealing with multiple currencies and legal entities across the globe. With the AccessPay platform, you are able to proactively manage multiple banking relationships and optimise global cash visibility by automating bank statement retrieval and financial data feeds from all your back-office systems. Robust approval processes and the ability to set up role based permissions and workflows within the AccessPay platform can help you stay in control of your business payments.

With a range of tools, the AccessPay platform can help you improve payment security, reduce the risk of fraud and give you total control over payment flows from your back-office systems all the way through to your beneficiary banks.

Automating payments through the AccessPay platform allows you to:

• Process payments via international and domestic payment schemes, or via a managed host-to-host connection with your banking partners

• Make high volume, high-frequency payments securely

• Reduce the risks of manual data entry and payment file approvals

• Tailor workflow and approval rules to your business needs for controlled access and visibility of payment files

• Mask sensitive transaction data

• Automate file transformation to easily comply with banking requirements and financial messaging standards

Automating the time consuming and risky process of cash and liquidity data gathering also allows you to:

• Automate bank statement retrievals

• View all your balances in one place, anytime, anywhere

• Make data-driven cash management decisions quickly and efficiently

• Automate cash transfers removing the reliance on creating reports manually

• Make your cash work harder by placing it in the accounts that will earn you the highest interest

• Create bespoke risk reporting and alerting on; large exposures, balance irregularities and liquidity usage

Key features

- Automate payment submissions across SWIFT, ACH, SEPA, Bacs & more

- Build powerful automation workflows between Acumatica and your corporate banking providers

- Enable custom bank integrations via our managed Host-to-Host connectivity service

- Automate bank statement retrievals

- Centralise cash visibility across your corporate banking estate

- Detect payment fraud and errors

- ISO20022 ready file transformation engine

About Access Systems UK LTD T/A AccessPay

AccessPay is a FinTech platform designed to support Finance and Treasury teams futureproof corporate banking operations.

The AccessPay platform provides Acumatica clients with secure, digital connections to banks and payment scheme across the globe, enabling automation of payments and cash management operations in order to deliver true corporate-to-bank integration via one unified platform. We\'re trusted by thousands of organisations across the globe to securely integrate and automate core finance & treasury operations every day - from securing payment runs, to gaining real-time cash visibility across corporate banking estates.

As the first cloud-based payments provider and SWIFT L2BA partner in the UK, we pride ourselves on our industry expertise. AccessPay is bank and file agnostic too, with experience supporting clients across Europe, America, APAC and Africa. If you\'re looking for a secure connection between Acumatica and your core banking services, get in touch to discover how we can help.

Resources

Customer Reviews

Your insights are valuable, be the first to rate this solution.

- Help your peers. If we all provide feedback on our business solutions, our collective wisdom will help take the pain out of purchasing decisions for everyone.

- Share feedback. Using a solution that has made your job easier or provided benefits to the team? Make your voice heard.

- Earn recognition. Your detailed, balanced reviews of the solutions that you know inside and out can position you as an expert.