Reviewed: Aug, 2023

Intercompany transactions represent a bookkeeping risk for any parent business with one or more subsidiaries. It’s only through careful intercompany accounting that you can avoid counting these transactions twice. Here’s how to handle intercompany reconciliation between your branches or other entities.

If you’re already entangled in the process of intercompany accounting, you know that it comes with the good, the bad, and the ugly.

Intercompany Transactions: The Good

The good news is that your business has grown. You have opened new operations in new markets. Maybe you manufacture products in a separate related entity that supplies finished goods to your entity that distributes. Maybe you have a central order fulfillment operation that sources products from multiple related entities based on availability, or product characteristics. Perhaps you also have a central organization that provides administrative services for all other related entities and then charges them for such services. The increasing complexity of your supply chain and/or administrative services is a result of increased business growth and expansion to multiple operating locations, and that’s great.

Intercompany Transactions: The Bad

The supply chain or administrative transactions between business units need to be processed quickly and accurately, so that inventory and/or cash positions reflect current levels for accurate transaction execution and decision-making. If each entity or branch has its own accounting and inventory systems, there can be delays in processing transaction between locations resulting in an inaccurate view of current operating results and the need to perform manual adjustments and reconciliations in order to get a precise “picture” of operating results.

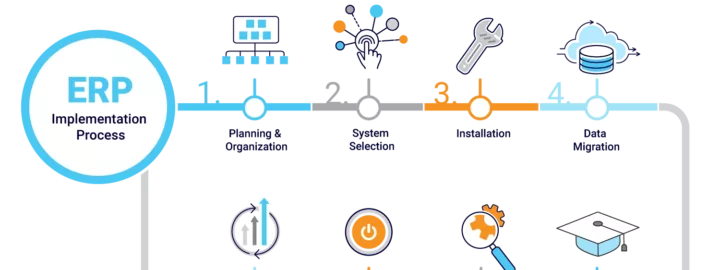

Ideally, the accounting across all business operations should be performed by and captured in a single system. In such a system, transactions between business units are “posted” in both simultaneously, so that inventory, cash, payable, and receivable balances accurately reflect current levels, and transactions are not duplicated.

Intercompany Transactions: The Ugly

Even if a single accounting system is used to process individual transactions, period end reporting for intercompany transactions presents additional issues.

The effect of intercompany transactions needs to be eliminated from consolidated Income Statement and Balance Sheet reporting. This implies that the accounting system can separately identify and aggregate all intercompany transactions. If and how an accounting system captures intercompany transactions will have a significant impact on the ease and accuracy with which consolidated reporting is performed. The accurate processing and reporting of intercompany transactions is more likely if done by a highly integrated accounting system specifically designed to handle such events than by dumping a General Ledger Trial Balance into a spreadsheet and manually adjusting account balances.

Intercompany accounting can be a particular burden for small and medium-size businesses (SMBs) that are expanding their organization structure in order to enter new markets or accommodate increased supply chain complexity. At the same time, SMBs do not have the internal resources to perform the necessary manual accounting adjustments. Additionally, many simple accounting systems affordable for SMBs lack the functionality to properly handle multiple entity or branch accounting.

With a product like Acumatica, “Branches” functionality in combination with “Intercompany Accounting module” are the perfect way to represent multiple, related companies, so a company with several businesses under its umbrella doesn’t have to buy several licenses to handle its intercompany accounting needs.

With the right accounting software, an SMB can avoid the bad, prevent the ugly and keep the good.

Acumatica’s Intercompany Accounting and Intercompany Reconciliation

Canada (English)

Canada (English)

Colombia

Colombia

Caribbean and Puerto Rico

Caribbean and Puerto Rico

Ecuador

Ecuador

India

India

Indonesia

Indonesia

Ireland

Ireland

Malaysia

Malaysia

Mexico

Mexico

Panama

Panama

Peru

Peru

Philippines

Philippines

Singapore

Singapore

South Africa

South Africa

Sri Lanka

Sri Lanka

Thailand

Thailand

United Kingdom

United Kingdom

United States

United States