Connect Acumatica to more than 14,000 financial institutions. Schedule bank transaction imports to Acumatica. Link savings, checking, and corporate credit card accounts to cash and expense accounts inside Acumatica. Eliminate manual reconciliation and matching with default settings, artificial intelligence, and machine learning.

Bank Feed Software

Save Time and Improve Data Accuracy with Automated Bank Feeds

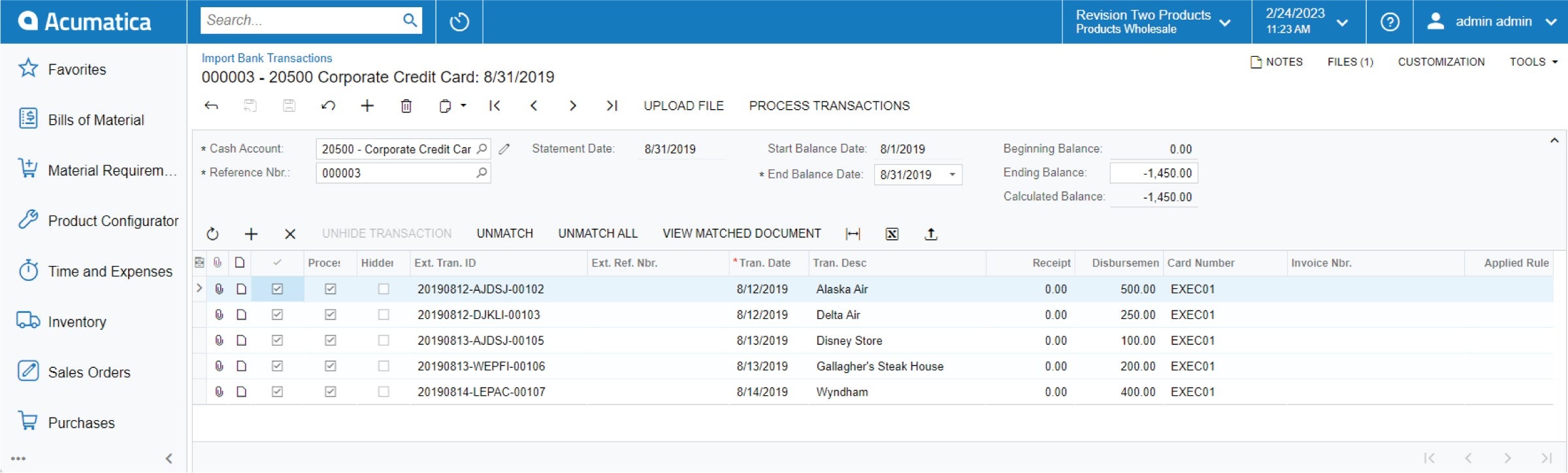

Schedule imports for savings, checking, corporate credit cards, investments, loans, and other financial accounts. Connect to multiple banks with varying import schedules per account. Eliminate manual reconciliation and matching with auto-match capabilities and default settings. Using customizable business rules and near real-time activity downloads, the software provides automated smart matching to existing transactions. Dashboards and reports highlight transactions that require attention. This software utilizes Plaid and MX, industry-leading connection platforms deployed by thousands of financial institutions and businesses, to securely aggregate and format data. Connections and data transfers use Multi-Factor Authentication (MFA), Advanced Encryption Standard (AES 256), and Transport Layer Security (TLS) for all information exchanges. Acumatica stores secure tokens for information transfers and does not store sensitive banking information.

Important Features of Bank Feed Software

The software utilizes industry-leading aggregators, Plaid and MX, to retrieve and format transactions from more than 14,000 financial institutions.

Multi-Factor Authentication (MFA), Advanced Encryption Standard (AES 256), and Transport Layer Security (TLS) ensures safety and security for all information exchanges.

Default settings, artificial intelligence, and machine learning automatically match bank transactions with Acumatica transactions. Match one bank transaction to one or more payments, invoices, receipts, credit memos, and debt adjustments.

Unmatched transactions are conveniently displayed in dashboard views for review and manual matching or categorization in Acumatica. Write-offs of AR balances and credits are supported.

Bank feed updates are logged at the record and field level in Acumatica, providing traceability for all financial data transactions.

Advanced mapping and custom data provider connections provide flexibility to automate virtually any business scenario.

Utilize predefined synchronization schedules to request a validation status update for pending credit card transactions that require validation from the processing center.

Dynamically create refund transactions from imported bank receipts that match to vendor debit adjustments and automatically record external reference numbers from the bank receipt in the payment ref field of the refund document.

Users can process BAI2 and BTRS bank feed file formats, enabling automatic processing of bank transactions, including corporate credit card receipts for employees specified in the bank feed settings.

Key Benefits of Bank Feed Software for your Company

-

Automate Processes

Schedule imports to occur automatically based on flexible, user-defined schedules. Smart matching eliminates reconciliation for recognized transactions.

-

Setup in Minutes

Connect to financial institutions in minutes with your corporate or personal credentials. Link financial accounts to General Ledger accounts with a few clicks.

-

Streamline Expenses

Use the software with Advanced Expense Management to automate expenses for corporate credit cards. Advanced Expense Management streamlines business expenses with flow-through to customer projects for review and customer billing. Automatically attach expense receipts to appropriate bank feeds. Automatically import bank transactions and create expense receipts based on downloaded transactions and send them for approval.

-

Integrate with Thousands of Financial Institutions*

Use the Bank Feeds option to automate and schedule imports by storing a secure token. Use the Bank Import option to download and import files from bank websites.

*Bank Feeds supports popular banks. Bank Imports may be needed for less common institutions.

Automate bank feed transactions on a configurable schedule or import data manually with secure data synchronization

Acumatica Bank Feed Software – FAQ

Bank feeds allow businesses to securely connect their savings, checking, and corporate credit card accounts to the software, which may be integrated within an accounting or Enterprise Resource Planning (ERP) solution. The software integrates with local and global financial institutions, enabling businesses to automate their import schedules and reconciliation processes.

It depends on the software a business chooses to implement. If a business implements modern, sophisticated software, matching transactions (pairing bank transactions to payments, invoices, receipts, credit memos, and debt adjustments), reviewing unmatched transactions, supporting write-offs of AR balances and credits, and tracing all financial data transactions occurs in a single system with personalized dashboards and out-of-the-box reporting.

With bank feeds software, businesses enjoy a number of benefits, including:

- Automatic imports based on user-defined schedules.

- Automated, intelligent reconciliation for recognized transactions and anomaly detection.

- Quick and secure connection to thousands of financial institutions.

- Ability to link financial accounts to General Ledger accounts with a few clicks.

- Reduced month-end close times.

- Access to real-time data for informed decision making.

And businesses can anticipate immense time savings and a reduction in human-based errors by eliminating manual data entry.

“I save about a quarter of my time by not having to do manual reconciliations for all the closings.” – Stacy Troiano, Controller, Seaport Capital

Acumatica UK Ltd. is an agent of Plaid Financial Ltd., an authorized payment institution regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 (Firm Reference Number: 804718). Plaid provides users in the United Kingdom with regulated account information services through Acumatica as its agent.

Canada (English)

Canada (English)

Colombia

Colombia

Caribbean and Puerto Rico

Caribbean and Puerto Rico

Ecuador

Ecuador

India

India

Indonesia

Indonesia

Ireland

Ireland

Malaysia

Malaysia

Mexico

Mexico

Panama

Panama

Peru

Peru

Philippines

Philippines

Singapore

Singapore

South Africa

South Africa

Sri Lanka

Sri Lanka

Thailand

Thailand

United Kingdom

United Kingdom

United States

United States