Powerful Financial Management Software, Solid Financial Management Foundation

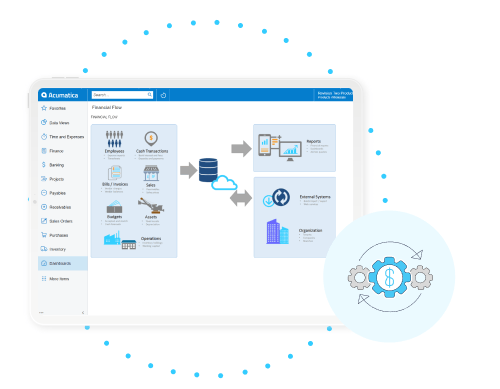

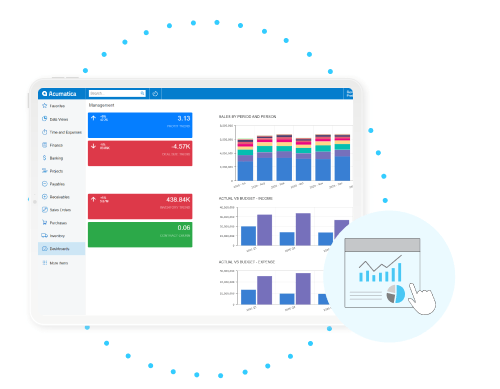

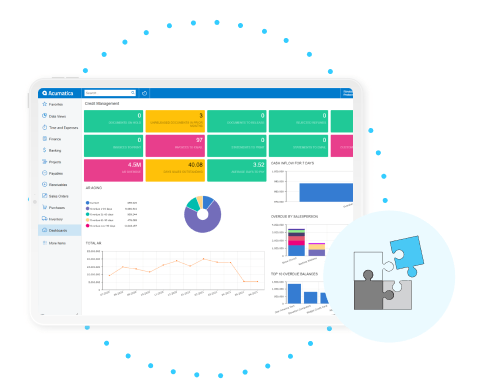

Acumatica’s financial management software takes managing your business’ assets, income, and expenses from complex to simple with configurable processes, mobile anytime access, and best-in-class accounting applications resting on a single, future-proof platform. To operate at peak performance, let Acumatica be the backbone of every financial decision you make.

Canada (English)

Canada (English)

Columbia

Columbia

Caribbean and Puerto Rico

Caribbean and Puerto Rico

Ecuador

Ecuador

India

India

Indonesia

Indonesia

Ireland

Ireland

Malaysia

Malaysia

Mexico

Mexico

Panama

Panama

Peru

Peru

Philippines

Philippines

Singapore

Singapore

South Africa

South Africa

Sri Lanka

Sri Lanka

Thailand

Thailand

United Kingdom

United Kingdom

United States

United States